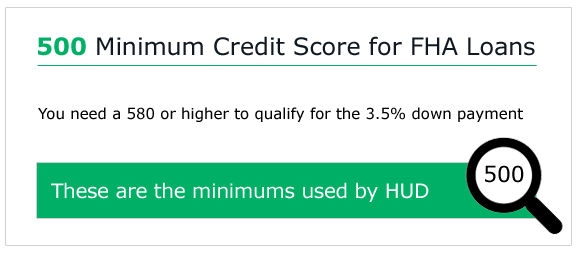

Summary: This article explains the minimum credit score needed for FHA loan approval in 2024. In short, borrowers need a score of 500 or higher to be eligible for the program, and a 580 or higher to qualify for the 3.5% down-payment option.

Some of the information that follows is based on the official HUD handbook for this mortgage program, and some of it is derived from our on ongoing conversations with FHA-approved lenders.

Key points from this article:

- In 2024, the minimum credit score needed for FHA loan eligibility is 500.

- In order to take advantage of the 3.5% down payment option, borrowers need a credit score of 580 or higher.

- But lenders can set their own requirements on top of those established by HUD.

- Most of the mortgage lenders we have spoken to require a credit score of 600 or higher for FHA loan approval.

- These lender requirements or “overlays” are not set in stone; they can vary from one company to the next.

Credit Score Needed for FHA Loan Approval in 2024

There are essentially two sets of requirements when it comes to the credit score needed for FHA loan approval:

- Borrowers must meet the minimum eligibility criteria for the program, and those rules are established by the Department of Housing and Urban Development (HUD).

- Additionally, the borrower must meet the mortgage lender’s minimum requirements for home loan approval.

When you use an FHA loan, you are not borrowing money from the government. The government insures the loan, but the funding itself comes from a mortgage lender in the private sector.

Official HUD Guidelines for Credit Scores

Let’s start with the official credit score needed for FHA loan eligibility in 2024.

The official guidelines for the Federal Housing Administration mortgage insurance program are found in HUD Handbook 4000.1, also known as the Single-Family Housing Policy Handbook. Within this document, we find the minimum credit score needed for FHA loan eligibility. Here’s what it says:

| If your score is… | Then you are… |

| 580 or higher | eligible for maximum financing (95.5% LTV) |

| between 500 and 579 | limited to a maximum LTV of 90% |

| 499 or lower | not eligible for an FHA-insured mortgage loan |

Lender Overlays Are Possible

As mentioned earlier, mortgage lenders can establish their own guidelines above the minimum requirements set forth by HUD. In industry jargon, this is known as an “overlay.”

Some mortgage lenders don’t impose overlays for FHA loans, while others do. Because of this, the minimum credit score needed for actual FHA loan approval can vary from one lender to the next. So they are not set in stone.

With that being said, many of the mortgage companies we have spoken to when preparing this article said that they set the bar somewhere between 580 and 620.

It’s also important to keep in mind that the credit score is just one of the things needed for FHA loan approval in 2024. Borrowers must also have a manageable level of debt in relation to their income, along with a minimum down payment of 3.5%.

Those are the most important requirements for FHA loan approval – decent credit, manageable debt, sufficient income to repay the loan, and an upfront down payment equaling 3.5% of the purchase price or appraised value.

Average FICO Scores Among Borrowers

Each month, the mortgage origination software company Ellie Mae publishes an “origination insight report.” True to its name, this report offers valuable insight into mortgage trends and standards. Among other things, it shows the average FICO credit scores for loans that were processed and closed using the company’s software.

Their latest report (as of publication time) contained data for the month of November. It provided a breakdown of the average credit score for FHA loans that were successfully closed. Those numbers are shown below. The score ranges are shown on the left. The percentage indicates how many borrowers had scores that fell within those ranges.

Note: The FICO credit-scoring model ranges from 300 to 850.

| FICO Score Range | Percentage of Loans |

| 500 – 549 | 2.14% |

| 550 – 599 | 5.20% |

| 600 – 649 | 23.01% |

| 650 – 699 | 34.74% |

| 700 – 749 | 21.88% |

| 750 – 799 | 10.87% |

| 800+ | 1.89% |

Bear in mind these are average credit scores among borrowers. These are not the minimum scores that are needed for FHA loan approval in 2018. But these numbers do give us some idea as to where most borrowers fall, in terms of their credit scores.

As you can see, the vast majority of FHA loans that successfully closed went to borrowers with credit scores between 600 and 799 on the FICO scale. Around 5% of loans went to borrowers with scores ranging between 550 and 599. And a relatively small number of closed loans went to borrowers with scores between 500 and 549.

The takeaway: A credit score of 500 or higher will meet HUD’s minimum requirement for FHA loans, and you might actually get approved in that range. But having a score of 600 or higher will put you in the more desirable range, increasing your chances for approval.

The disclaimer: This article does not constitute official policies or guidelines. We are not affiliated with HUD in any way. This information has been presented to give borrowers a general idea of what score is needed to qualify for an FHA loan. The only way to find out for sure if you are qualified for this program is to speak with a HUD-approved mortgage lender.