In this guide: an explanation of the upfront and annual mortgage insurance premiums required for FHA loans, including their requirements and costs. Fully updated for 2024.

FHA loans offer a lot of benefits for home buyers. Specifically, this programs allows you to buy a house with a down payment as low as 3.5%, even if you've had credit issues in the past.

But FHA loans also require borrowers to pay for mortgage insurance, which protects lenders against the risk of borrower default. This is one of the downsides of the FHA loan program, and something you should consider if you're thinking about using it.

FHA Mortgage Insurance Requirements

The FHA home loan program is built around insurance. It involves insurance funds revolving around through three different parties—the borrower, the lender, and the government.

Borrowers pay into the fund. The FHA manages it. And lenders benefit from it.

Here's how insurance money "flows" through the system:

- Borrowers pay an insurance premium for their FHA loans, in some cases for as long as they keep the loan.

- The FHA deposits those premiums into their Mutual Mortgage Insurance (MMI) Fund, as required by Congress.

- Lenders file insurance claims when their borrowers default, and use those funds to cover any losses.

This arrangement gives lenders extra protection against the risk of borrower default. But that's not all. It also makes it possible for borrowers with lower credit scores or smaller down payments to qualify for FHA loans.

FHA mortgage insurance comes in two forms. There's an upfront premium that can be paid at closing or rolled into the loan, as well as an annual premium that's paid in monthly installments as part of your mortgage payment.

What to remember from this section: Borrowers pay for the insurance, but it primarily benefits mortgage lenders by mitigating their risk.

1. Upfront Mortgage Insurance Premium

The upfront mortgage insurance premium (UFMIP) is a one-time fee paid at closing or rolled into the loan amount. It usually amounts to 1.75% of the base loan amount.

According to HUD: "The UFMIP charged for all amortization terms is 175 Basis Points (bps), unless otherwise stated..."

For example, if you were to borrow $300,000 to buy a home with an FHA loan, the upfront MIP would probably come out to $5,250. Because $300,000 x 0.0175 = $5,250.

The upfront MIP helps fund the FHA's insurance fund, which covers potential losses incurred by lenders in the event of borrower default. It provides immediate protection to lenders and also helps to ensure the availability of financing for borrowers.

Key point: Despite the "upfront" label applied to this FHA mortgage insurance premium, you have some flexibility as to when and how you pay it. As mentioned above, the upfront MIP charge can be financed into the loan and paid off over time. In this scenario, the total loan amount is simply increased by the financed UFMIP amount.

As it states on the HUD website:

"The UFMIP must be entirely financed into the Mortgage or paid entirely in cash. Any UFMIP amounts paid in cash are added to the total cash settlement requirements. However, if the UFMIP is financed into the Mortgage, the entire amount is to be financed except for any amount less than $1.00."

2. Annual Mortgage Insurance Premium

There's also an annual mortgage insurance premium that can vary based on the length of the loan and other factors. For many borrowers who use an FHA loan to buy a house, the annual MIP equals 0.55% and must be paid for as long as they keep the loan.

The annual mortgage insurance premium is also referred to as the "periodic" or "monthly" MIP, because it is collected in monthly installments as part of your mortgage payment.

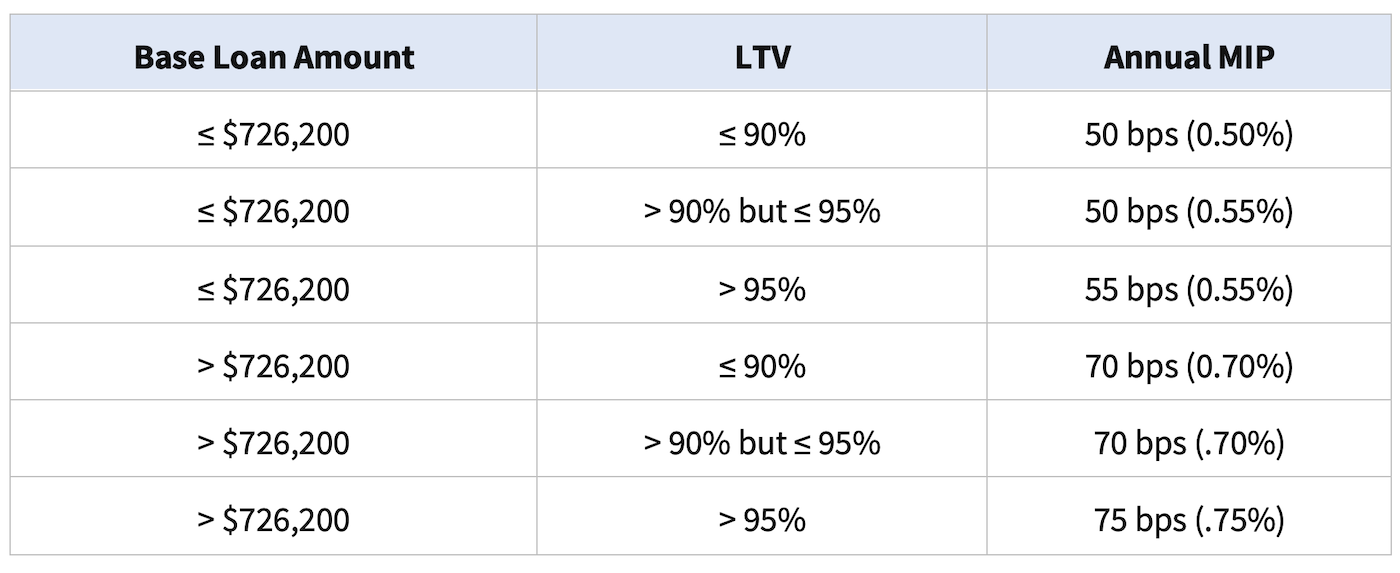

Annual MIP for Loan Terms of More Than 15 Years

If you take out a typical 30-year mortgage (or anything greater than 15 years), your annual FHA mortgage insurance premium will be as follows:

Example: If your loan amount is equal to or less than $726,200, and you make the minimum down payment of 3.5% (for an LTV of 96.5%), your annual MIP would be 0.55%.

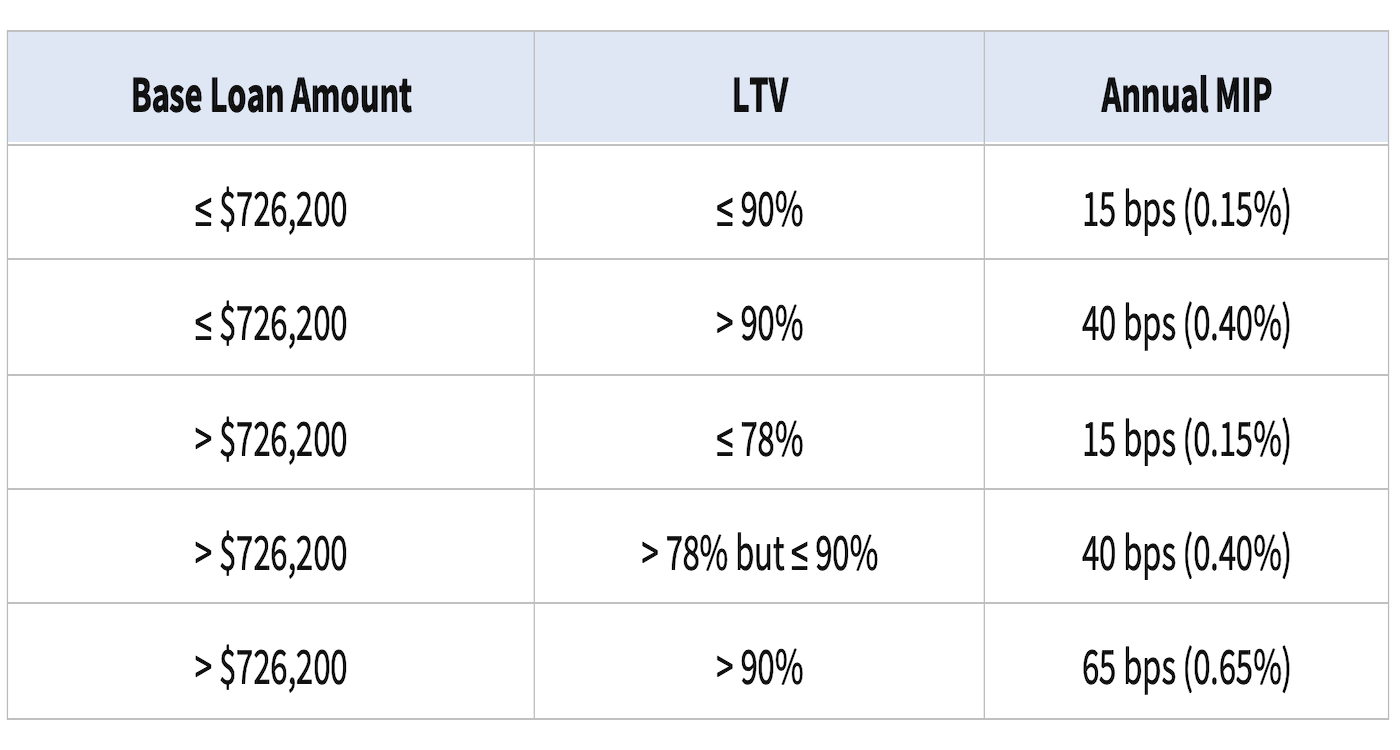

Annual MIP for Loan Terms of 15 Years or Less

If you take out an FHA loan with a repayment term of 15 years or less, you'll have a lower annual mortgage insurance premium as shown below:

Example: If your loan amount is equal to or less than $726,200, and you make a down payment of 10% (for an LTV of 90%), your annual MIP would be 0.15%.

How Long You Have to Pay It

For most borrowers, the annual FHA mortgage insurance is required for the life of the loan. But there are some scenarios where it might only be applied for a duration of 11 years.

Here are the general guidelines:

- If your initial loan-to-value (LTV) ratio is 90% or less, you will pay the annual MIP for at least 11 years. After that, you may be eligible to cancel the MIP.

- If your initial LTV ratio is more than 90%, you will likely pay the annual MIP for the entire duration of the loan.

To put it differently: If you use an FHA loan and your down payment results in an LTV ratio of 90% or less, you will have to pay the annual MIP for a minimum of 11 years. If your down payment results in an LTV ratio higher than 90%, you will likely pay annual FHA mortgage insurance for as long as you keep the loan.

In contrast, the private mortgage insurance (PMI) applied to conventional home loans can be cancelled once a homeowner reaches a certain level of equity. This is one of the key differences between FHA and conventional loans. PMI on conventional loans can eventually be cancelled, while FHA annual mortgage insurance often cannot.

The bottom line: Most borrowers who use FHA loans do so because the program allows for a down payment as low as 3.5%, along with flexible qualification criteria. If you make the minimum down payment of 3.5% for an FHA loan (or anything in that range), you'll probably have to pay the annual MIP until you either pay off or refinance the loan.

Disclaimer: Specific circumstances can vary from one borrower to the next. So it's always best to consult with your lender or refer to official HUD guidelines for precise information regarding MIP cancellation on FHA loans.

Frequently Asked Questions

As you can see, FHA mortgage insurance premiums are somewhat confusing. The annual MIP, in particular, can be hard to understand due to the different variables that are involved.

We want you to leave here with a clear understanding of how FHA mortgage insurance works—and how it affects you as a borrower. So wrap up by addressing some of the most frequently asked questions from borrowers.

What is FHA mortgage insurance?

FHA mortgage insurance is a government-issued policy that protects mortgage lenders against losses if a borrower defaults on a home loan that's insured by the Federal Housing Administration.

Why is FHA mortgage insurance required?

It's required to mitigate the risk for lenders and improve access to homeownership for borrowers with lower down payments or credit scores. The entire FHA loan program is built around insurance and essentially functions like a pooled insurance fund.

How does it benefit me as a borrower?

FHA mortgage insurance benefits borrowers by enabling them to qualify for loans with lower down payments, higher debt ratios, and/or past credit issues.

Borrowers who have been turned down for conventional mortgage financing can often qualify for FHA loans, due to their more flexible requirements. It's the government-provided insurance that makes this possible.

Do regular home loans also require mortgage insurance?

Conventional loans (that are not backed by the government) only require mortgage insurance in certain situations, like when the loan-to-value ratio rises above 80%. It's called "private" mortgage insurance, or PMI, because the policies are issued by insurers in the private sector, rather than by the government.

PMI can be avoided by making a down payment of 20% or more, or by combining two loans so that neither one has an LTV above 80%. PMI can be cancelled when the homeowner reaches a certain level of equity, whereas FHA mortgage insurance is often required for the life of the loan.

How much does FHA mortgage insurance cost?

The upfront premium is typically 1.75% of the loan amount; it can be paid at closing or financed into the loan. The annual premium comes out to 0.55% for most borrowers who use FHA loans, but it can vary based on the loan amount and term. See the tables above for a complete breakdown.

Can I roll them into my loan?

Yes, both of the FHA mortgage insurance premiums can be "rolled into" the loan and paid off over time. Despite its name, the upfront MIP can either be paid at closing or financed into the loan. The annual premium gets divided into 12 monthly payments and added to the monthly mortgage bill.

How long do I have to pay FHA mortgage insurance?

This will depend on the size of your down payment.

Most borrowers who use the FHA loan program make a down payment below 5% (and down to the minimum of 3.5%). In such cases, the borrower typically has to pay the annual FHA mortgage insurance premium for as long as they keep the loan.

But the rules are different for larger down payments. If you make a down payment of at least 10% on your home purchase, your FHA MIP should expire after 11 years.

Are the premiums tax-deductible?

Unfortunately, FHA mortgage insurance premiums (MIP) are generally not tax-deductible as of the current tax year. Even so, you should consult a tax professional with any questions you have on the subject of mortgage-related tax deductions.

Does FHA mortgage insurance cost more than PMI?

It's difficult to compare the cost of FHA mortgage insurance premiums (MIPs) and the premiums associated with private mortgage insurance (PMI).

For one thing, PMI costs can vary widely due to the borrower's credit score, down payment amount, and loan terms. So a borrower with a low credit score might pay more for PMI on a conventional loan than they would pay for FHA mortgage insurance, which is not based on credit scores.

On the other hand, for a borrower with excellent credit, PMI might be the cheaper option.

This is one of several factors you'll need to consider when choosing between an FHA or conventional home loan. You need to compare the total costs associated with each option, including the monthly payments as well as the total interest costs over time.

Where can I find more information on this subject?

Borrowers who have questions about FHA mortgage insurance or other aspects of this program can contact the Department of Housing and Urban Development (HUD). You can email HUD directly at answers@hud.gov, or call (800) CALL-FHA (225-5342).

You can also find answers through the FHA Resource Center.

Disclaimers: Mortgage loan transactions can vary from one borrower to another due to a wide range of factors. As a result, portions of this article might not apply to your particular situation. This article is intended for a general audience and should not be construed as financial advice. We encourage you to continue your research beyond our website.